back to all posts

back to all posts

Spotlight: Barracuda Networks WAF Market Report

Business Overview

Barracuda Networks protects cloud-based applications and networks from a variety of digital threats including spam, spyware, trojans and viruses. In addition, its storage and networking products safeguard and support customers’ critical data.

Until its acquisition by Thoma Bravo, the company had raised some 46 million USD in venture funding since its inception in 2003 from a range of established sources including Sequoia Capital. These respective rounds of investment and acquisition have bolstered the business’ ability to rapidly innovate in the emerging field of AI-powered cyber security, a market set to exceed 300 billion USD by 2024 globally according to Market Study Report.

This has helped Barracuda grow a strong suite of capabilities that support some 150,000 customers, including many of the world’s biggest names in technology like Boeing, Microsoft and the US Department of Defense.

Global Market Outlook

The cyber security market is undergoing a time of unprecedented global growth, driven by recent waves of high-profile security breaches and design flaws that impacted user and investor confidence in the digital market.

As a result, while information security spend is set to reach 118 billion USD globally in 2018, according to Gartner, outlay on security technology alone at the enterprise level has grown 9.1% since 2017 according to estimates by Canalys.

This rapid pace of growth is set to continue well into the next decade, with every region currently experiencing similar levels of growth in spend and adoption of cloud-based security products. EMEA, in particular, is experiencing strong demand for cyber security software at the SMB to mid-tier level following the European Union’s ratification of region-wide General Data Protection Regulation (GDPR).

Meanwhile, with financial losses per average impacted company growing 62% 2014-Q1 2019 globally, according to MarketWatch, businesses at every level are now choosing to invest in cyber security solutions earlier versus dealing with the fallout from attacks.

Business Benefits

Since its acquisition, Barracuda’s focus on rolling out cutting-edge products has helped it take advantage of the growing demand for reliable security solutions.

For example, the launch of its Firewall Insights analytics platform in June 2019, as well as integrations for core business products like Office 365, have helped the business earn continued recognition for its core competencies and offerings.

Meanwhile, the quality of its services has been widely recognized by sources such as Forrester research, which gave Barracuda the highest score possible for its cloud integration, deployment options, incident response, focus on customer support and success.

This second capability is especially significant at a time when businesses are shifting to Security as a Service models rather than in-house solutions.

As a result, the outlook for Barracuda looks bright, particularly at the enterprise level, which accounts for 60% of the market for these services.

Prognosis: Innovation and Account Management Key to Success

However, a new wave of strategic acquisitions by some of the biggest players in the sector like Symantec’s purchase of Javelin Networks may spell trouble ahead for Barracuda.

New mergers will put pressure on Barracuda’s ability to out-innovate the competition and invest in a broader suite of services not offered by its rivals.

Similarly while adoption of cloud-based security solutions by businesses in almost every sector other than energy, according to Bloomberg, keeps growing, few organizations are addressing how this is managed and accounted for internally.

This state of affairs will continue to cause complications for solution providers looking to identify relevant stakeholders and budgets at the prospect or upsell level.

Intricately Analysis

Intricately has conducted an analysis of Barracuda’s customer base, which draws on data from Barracuda’s Web Application Firewall (WAF) product, to identify key trends and competitive insights to inform future growth strategy.

This report analyzes data from 37,558 WAF customers, who deploy the WAF to monitor and protect website traffic. This particular product area of the business has grown roughly 16% over this timeframe, a strong performance in the field.

Barracuda Customer Profile

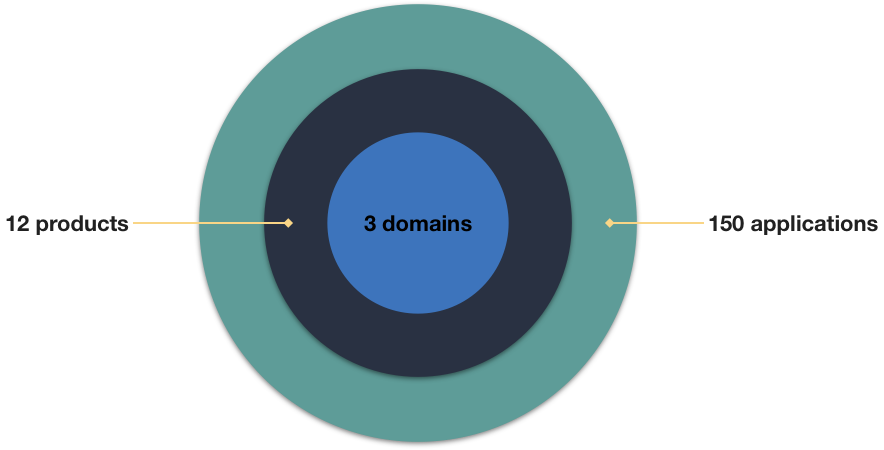

Barracuda’s customers typically oversee a complex range of web services and solutions using a small number of providers:

Meanwhile:

- 20% are AWS customers

- 7% are Microsoft Azure customers

- 71% deploy On-Premise Infrastructure

- Only 1.5% run Big Data applications

This application complexity in the field indicates highlighting WAF’s ease of use will play to Barracuda’s advantage, particularly among mid-tier prospects.

Geographic Footprint

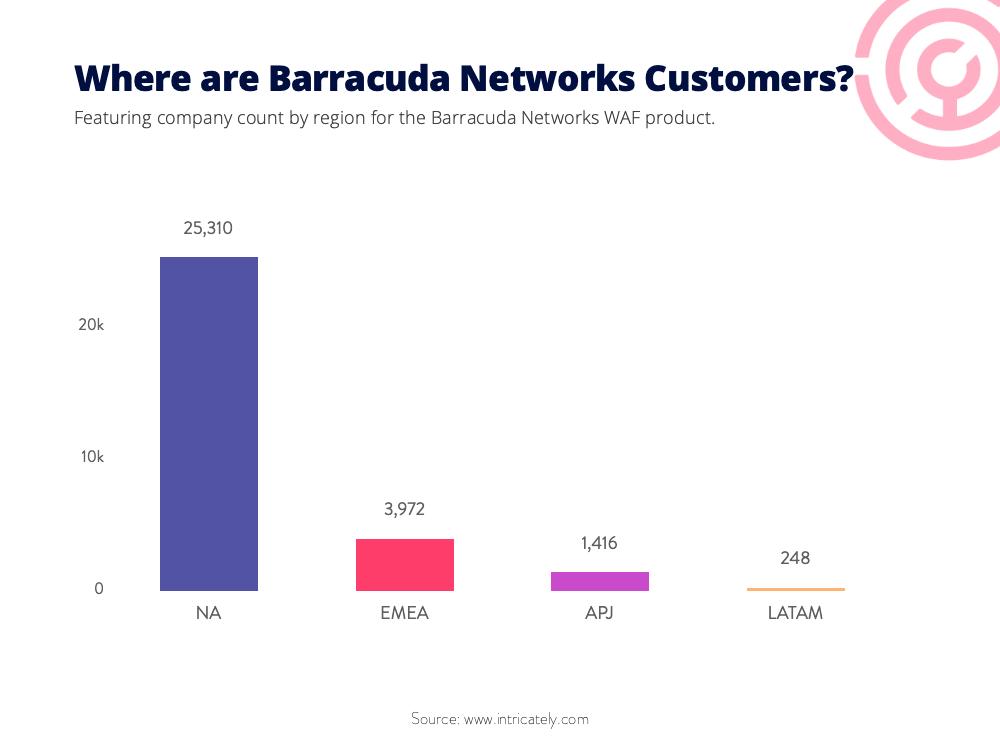

Our proprietary analysis reveals the majority of Barracuda’s WAF customers are located in North America, indicating strong potential for growth in other regions.

Meanwhile, fewer than 1% of customers are located in LatAm despite a predicted Compound Annual Growth Rate (CAGR) of 12.3% through to 2023 for the cyber security market in the region, worth some 20.65 Billion USD by BusinessWire.

Sales Analysis

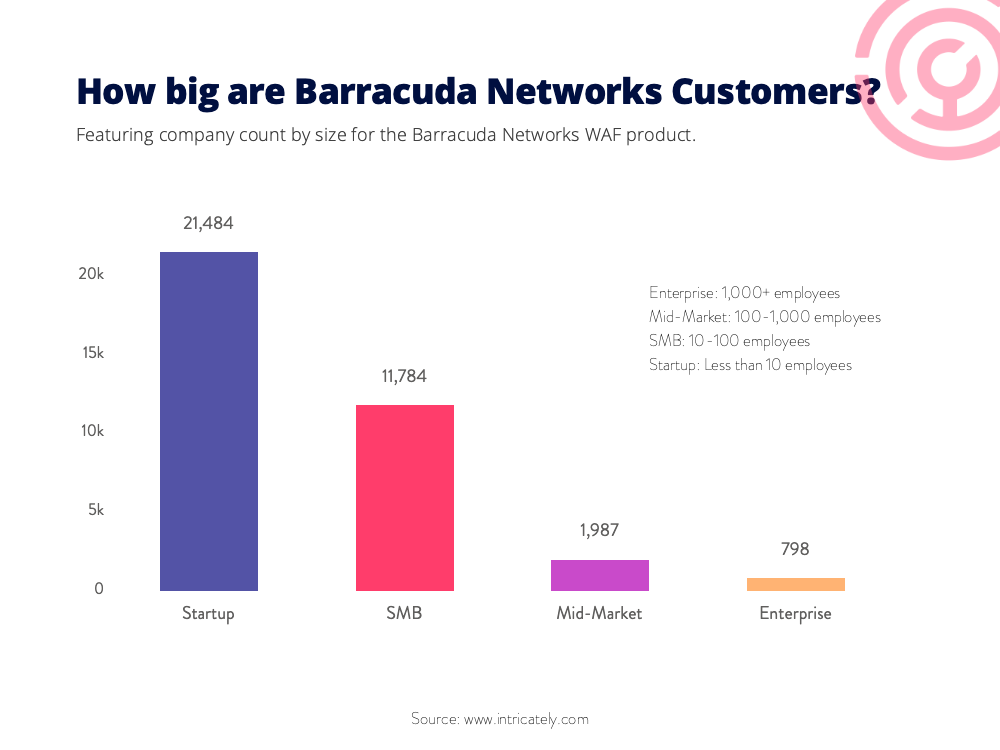

Furthermore, even though Barracuda’s top WAF customers comprise some of the biggest names in technology, businesses employing fewer than 100 people account for 92.3% of WAF’s sales:

Top Enterprise Customers

AT&T Inc.

Samsung Group

Adobe Systems Inc.

Booking.com B.V.

Pearson Plc.

A wealth of small business customers shows Barracuda has done well to target this end of the spectrum. These companies may feel particularly vulnerable to attack given limited liability budgets and the need to cultivate their customers’ trust.

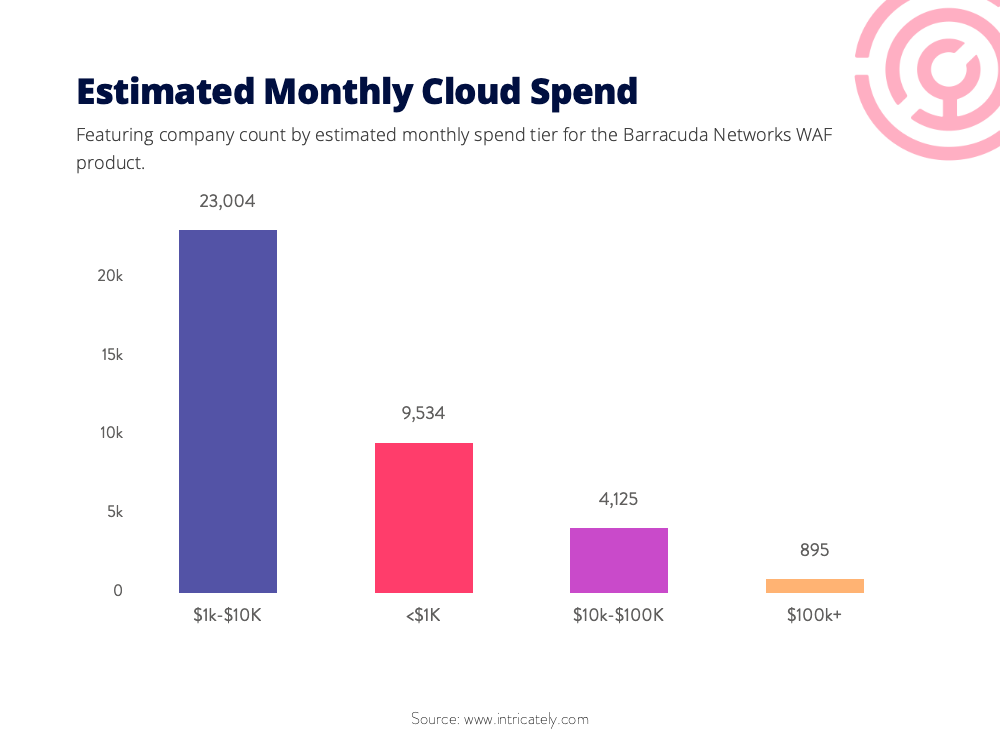

This customer split also highlights why on average, Barracuda’s WAF customers spend a modest $1-10k per month on its services:

However, our analysis reveals 4571 of Barracuda’s enterprise customers have the potential to extend their spend to over 100,000 USD per month on cloud services.

This represents significant upsell revenue opportunity for Barracuda.

Competitive Analysis

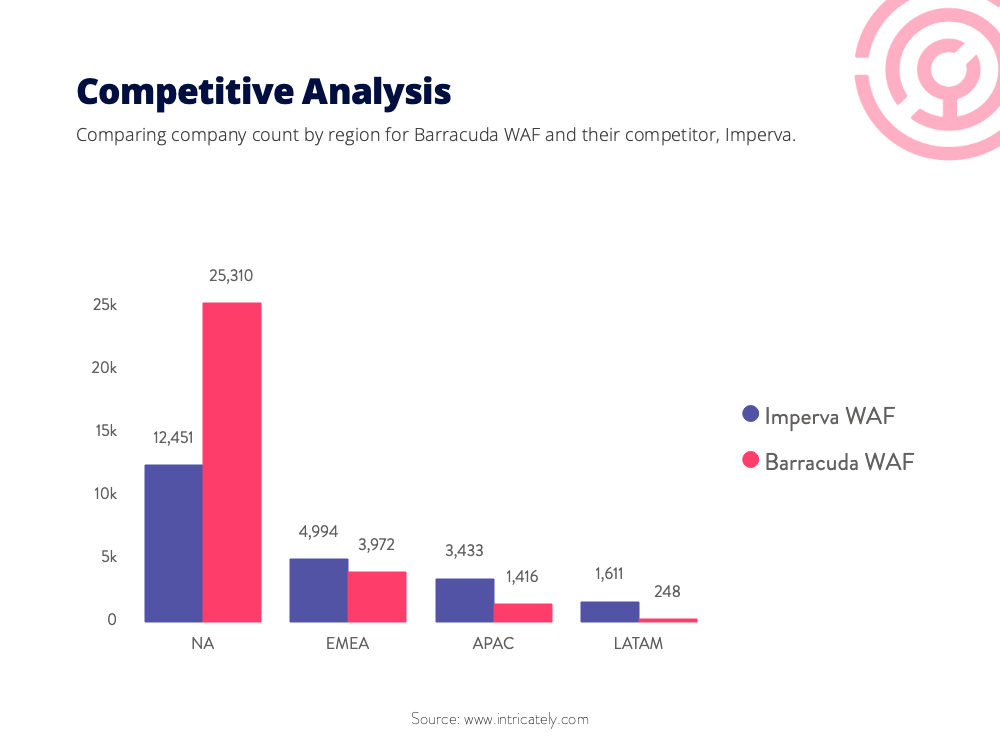

Though Barracuda outperforms cyber security competitor Imperva, with 8% fewer customers, when it comes to SMBs, the business still has some way to grow sales outside North America, especially in APAC and LATAM.

In these regions, Barracuda’s accounts only represent 6% of total global sales compared to 40% of Imperva’s. A more balanced portfolio of accounts potentially makes Imperva less prone to economic fluctuations in any single market.

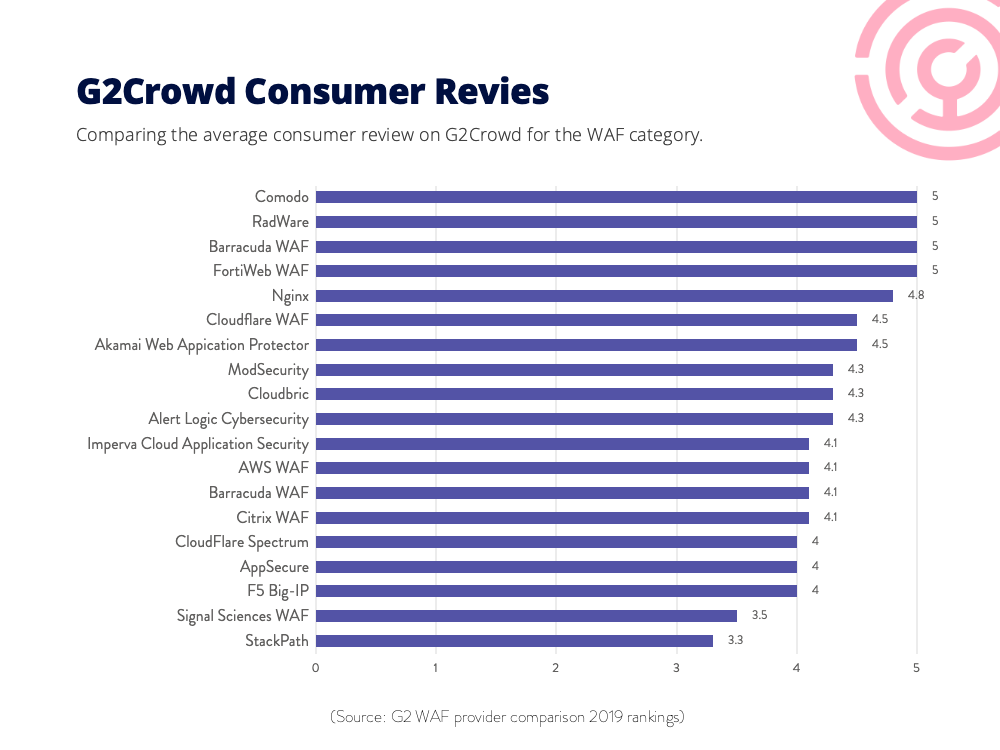

Meanwhile Barracuda’s standard WAF earns a relatively high customer rating (4.1 out of 5), which is similar to Imperva’s, ranking in the top 20 names in the cloud security space for ease of use.

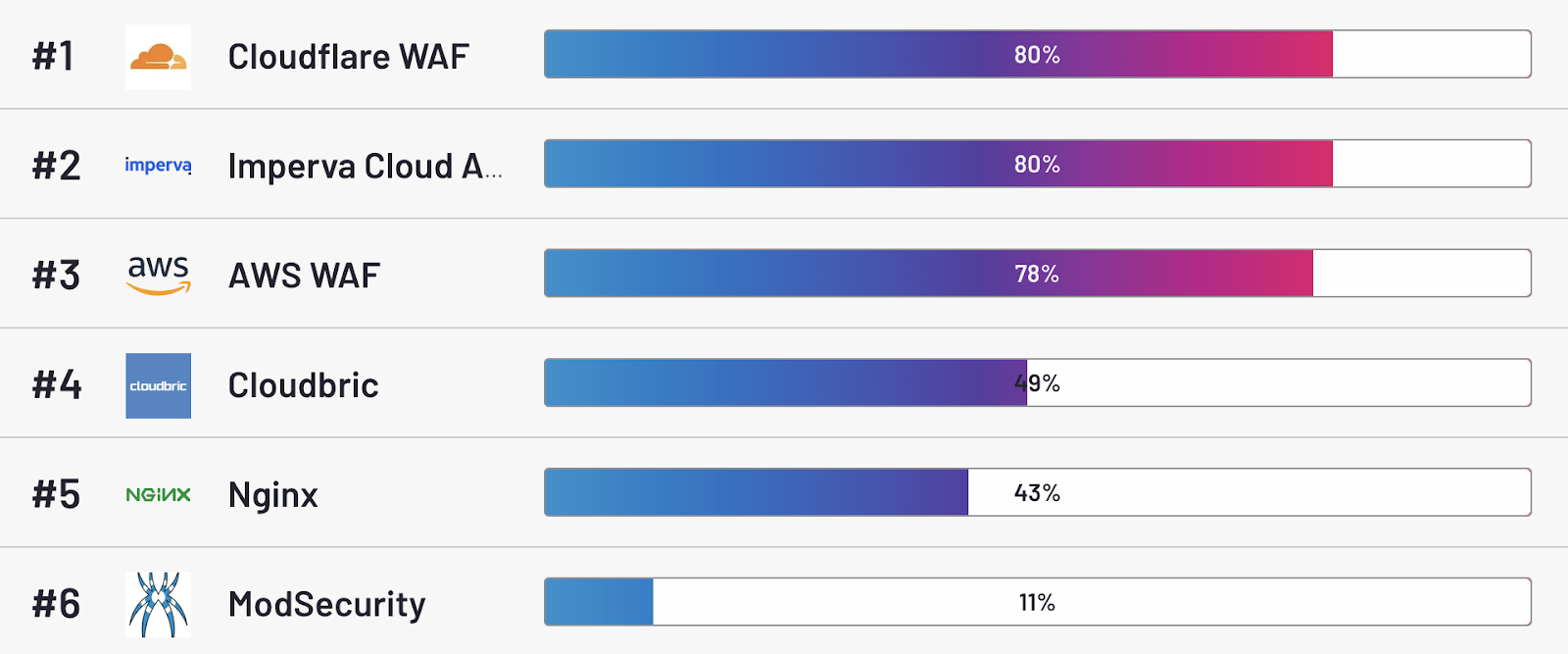

Overall however, Cloudflare WAF and Imperva garner the most positive reviews, especially from SMBs. In particular these brands earn recognition for their friendly customer service and, as a result, the sense of security they provide to customers.

Summary

Overall, our analysis reveals Barracuda’s WAF product has done particularly well to capture mid-sized businesses in North America, though much work still needs to be done in other regions.

At the same time, our proprietary data has uncovered a large potential upsell opportunity to shift many existing mid-tier WAF customers into the top sales tier.

Where We Sourced This Data

This data has been collected by Intricately’s proprietary sensor network, which monitors 8 million businesses’ usage of and spend on 21,000 cloud-based products and services around the globe.

Using its proprietary Global Sensor Network, deployed in more than 150 points of presence (PoPs), Intricately offers a comprehensive view into how organizations deploy, utilize, and invest in their digital products, applications, and infrastructure.

Our data platform currently powers the go-to-market strategy for the world’s leading cloud service providers, including Verizon, Snowflake and Amazon Web Services. These organizations rely on us to review market potential, segment, prioritize and engage with prospects at the right time.

About Intricately

Intricately gives cloud sales and marketing teams an unfair advantage in finding and acquiring new customers, building advanced scoring models, getting proactive notification of sales cycles, spotting churn before it happens, and more.

Our sophisticated data platform provides a detailed picture of your prospects’ cloud products and technology contracts so you can target your ideal buyers when they’re ready to purchase. We show you the true spending potential of your target customers.

Our Enterprise Data Platform helps the leaders in cloud forecast, prioritize, and close new business. Contact us for a demo today!

3 Trends Shaping the Evolving Cloud Hosting Market

4 Ways Cloud Marketing Leaders Can Get the Most From Their Budgets in 2022

How to Perform Account Segmentation and Prioritization

Fortinet: Analyzing Fortinet's WAF Customers And Competitors

Website Visitor Tracking Reviews