back to all posts

back to all posts

Spotlight: Salesforce & The New 360 Customer Platform

Introduction

Salesforce has grown well beyond its start a decade ago as the first cloud-hosted customer relationship management (CRM) solution for enterprises. While its dominant source of revenue remains its subscription and support-based CRM solution, it has grown through many strategic acquisitions in complementary areas such as sales and marketing automation (e.g., ExactTarget and Pardot), platform-as-a-service for e-commerce solutions (e.g., Heroku and Demandware), data management platform (e.g., Krux and Data.com), hybrid cloud integration (e.g., Mulesoft), customer support for small businesses (e.g., Desk.com) and data visualization (e.g., Tableau), among others.

Salesforce, headquartered in San Francisco, has organized its product offerings into a number of billion-dollar cloud businesses — Sales Cloud, Service Cloud, Marketing and Commerce Cloud, Data Cloud, etc. — styling itself overall as a Customer Success Platform. Salesforce has further unified these platforms into Customer 360, which connects enterprise data from multiple sources to provide a single, unified view of a customer across all departments and engagement channels. In fact, this set of interrelated cloud offerings provides Salesforce the ability to upsell to both existing and newly-acquired customers additional tools and services to improve and grow their markets.

While Salesforce’s principal revenue source in North America, it has a strong presence worldwide. Its financial performance has been consistently stellar, and expects to reach its target of ~26 billion dollars in revenue by 2023.

The remainder of this report summarizes some unique data points about Salesforce that has been constructed using Intricately’s proprietary data acquisition and analysis tool.

Methodology

The data in this report has been collected via Intricately’s proprietary Global Sensor Network, deployed in 150 points of presence (PoP) spread across six continents and 100+ countries. Intricately monitors public-facing data flowing across these PoPs, and currently monitors traffic data from 21,000 unique cloud products at ~7 million companies worldwide. For more information about Intricately’s Global Sensor Network and data collection, please see this Medium article.

This unique solution allows Intricately to provide a comprehensive view based on analyzing over 140 data points to reveal how organizations deploy, utilize, and invest in their cloud products, applications, and data delivery infrastructure. This real-time data-driven market intelligence intro cloud and SaaS ecosystems allows Intricately’s customers to identify and target market opportunities.

Salesforce Data Insights

Intricately’s data analysis reveals much interesting information about Salesforce customers that might not be visible in conventional company analyses. Some highlights from our data follow.

Products

While there are many Salesforce products, Intricately has visibility into only the following products:

- CRM solution: The original product, since considerably enhanced, to manage a company’s relationship with its existing and potentially new customers.

- Heroku: A platform-as-a-service (PaaS) that allows developers to create and run their own applications.

- Demandware: A cloud-based e-commerce platform.

- Pardot: A marketing automation platform for B2B sales and marketing.

- ExactTarget: An earlier marketing automation and analytics platform, with products different from those acquired through Pardot and iGoDigital.

- Desk.com: Customer support (helpdesk) solution for small businesses (to be retired).

- iGoDigital: Web-based commerce tools and product recommendations designed to increase customer interaction.

- Krux: A data management platform for marketers, publishers and ad agencies.

- Tableau: A data visualization solution.

Of the 180K Salesforce customers worldwide visible to Intricately, the following chart shows the number of customers for each of these nine products (as of June 2019):

Customers

Salesforce’s customer base spans the entire range from small to large, with diverse businesses and therefore varied product requirements. Within the total Salesforce customer count shown above, Intricately’s data reveals that customers deploy an average of 4 domains, use 14 products and 574 cloud applications.

Distribution by region and company size

Intricately’s data on Salesforce customers for the products provided earlier shows their geographical distributed as follows:

As of June 2019, the YoY customer growth rate is 14%. Intricately monitors the customer growth for all nine products listed above and can provide YoY or QoQ analysis for the previous 4 years.

Salesforce’s customers visible to Intricately, for the products described earlier, are distributed by company size as shown in the following chart:

Cloud services spend

Intricately has a unique, proprietary tool to calculate how much the companies it has visibility into spend on their cloud infrastructure. This calculation is based, among other factors, on the cost of the provider’s solution and the traffic for the expected use cases.

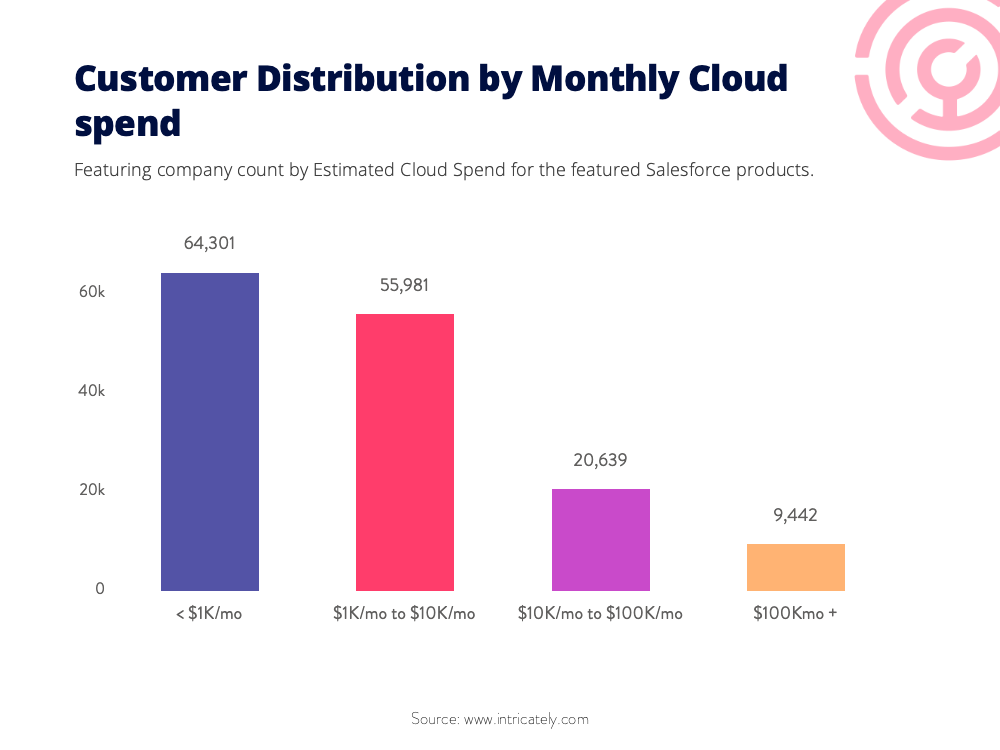

Analyzing Salesforce customers for the products listed earlier, Intricately’s latest data shows the following spend distribution:

Note particularly that the data shows a large segment of customers that spend more than $100,000 per month on cloud infrastructure services — that’s more than $1M annually.

Intricately also computes a business’ Spend Potential by comparing the profile of the business to similar businesses around the world and incorporating their potential growth trajectory.

Intricately’s Spend Potential analysis reveals that over 1,800 companies within Salesforce’s customer base have the potential to spend over $100,000 per month on cloud services, who don’t already. This represents significant upsell revenue opportunity for Salesforce.

Types of Cloud Deployment

Salesforce’s customers offer diverse makeup when it comes to the sophistication of their cloud deployments. This provides tremendous insight into the potential strategies that Salesforce can utilize to upsell and cross-sell customers.

For example, not everyone has a use for Tableau or Heroku; so it’s important to only focus on selling those to customers that need it. This type of insight is revealed by Intricately’s data.

Intricately has found it useful to describe a customer’s cloud deployment infrastructure using the following descriptors:

- Cloud Leader: At least one of the leading Cloud providers are deployed. Leading Cloud providers include AWS, Azure, Alibaba, and Google Cloud Platform.

- Cloud Laggard: A Cloud provider is being used but no Leading Cloud providers are deployed and no Data Center solutions are deployed.

- Data Center: A Data Center solution is deployed exclusively. There are no Cloud providers deployed.

- Hybrid: There is a combination of Data Center and Cloud providers deployed.

- None: There are no infrastructure hosting providers in place.

The following chart shows the distribution for Salesforce customers (visible to Intricately) on the degree and type of cloud deployment based on the sophistication criteria described above.

Based on these descriptors, which identify a company’s level of “sophistication” with respect to deploying cloud infrastructure, Intricately finds that 22% of the companies analyzed run their business with the cloud leaders, while 24% don’t use any infrastructure hosting. Of those customers using Cloud Leaders, 36% use Amazon Web Services (AWS) for their cloud infrastructure, while 10% run theirs on Microsoft Azure. AWS & Azure are considered competitive to Salesforce’s Heroku product.

Again, such insights provide an opportunity for cloud providers to focus marketing and sales efforts on targeted companies.

Competitive landscape

Salesforce’s large portfolio of products and worldwide customer base places it well ahead of other players in the on demand, cloud-hosted CRM market. This is clearly visible in the latest Gartner magic quadrant for CRM customer engagement, where Salesforce widely outpaces its competitors in the Leaders quadrant for completeness of vision and ability to execute on it. However, Salesforce has a range of products beyond CRM that support e-commerce, marketing and sales, etc. It is here that Salesforce faces credible competitors, including Microsoft, Oracle, and SAP for enterprise customers, as well as niche players that target SMBs and startups.

With the ongoing digital transformation of customer engagement, marketing and sales through the use of machine learning, AI, Big Data and analytics, Salesforce has had to play catchup with several large competitors, such as Google and Microsoft. Intricately’s data shows 32K Salesforce customers have a use case for analytics, Big Data, and Data Lakes, while some 8% deploy Big Data applications. Salesforce’s recent acquisition of Tableau fills this data analytics and visualization gap in its product portfolio, an area already offered by competitor products such as Google Cloud, Microsoft Power BI, IBM Cognos Analytics, etc.

New domains where Salesforce needs to focus include Internet of Things (IoT) and blockchain-based solutions for enterprises. Salesforce can expect to play catchup with industry heavyweights — Oracle, IBM, Microsoft, together with their industry partners in various verticals — who are ahead in prototypes and solutions for these new growth areas.

About Intricately

Intricately gives cloud sales and marketing teams an unfair advantage in finding and acquiring new customers, building advanced scoring models, getting proactive notification of sales cycles, spotting churn before it happens, and more.

Our sophisticated data platform provides a detailed picture of your prospects’ cloud products and technology contracts so you can target your ideal buyers when they’re ready to purchase. We show you the true spending potential of your target customers.

Our Enterprise Data Platform helps the leaders in cloud forecast, prioritize, and close new business. Contact us for a demo today!

3 Trends Shaping the Evolving Cloud Hosting Market

4 Ways Cloud Marketing Leaders Can Get the Most From Their Budgets in 2022

How to Perform Account Segmentation and Prioritization

Introducing Intricately's 2021 Open Source Cloud Market Snapshot: Insights to Drive Revenue in an Open Source Business Model

Pay Attention to These EMEA Enterprises Spending Millions on Cloud Services Each Month