back to all posts

back to all posts

How New Relic Can Define 2020 And Beyond

Business Overview

New Relic cuts through the confusion of apps and analytics to provide businesses with clear, actionable insights. Founded in 2013 and a clever anagram of the founder’s name, Lew Cirne, it provides full-stack visibility and analytics with more than 14,000 paid business accounts. Companies can identify and fix potential problems and errors in their systems before it becomes a problem with New Relic’s analysis.

In the age of cloud and analytics, companies can quickly find themselves overwhelmed. Between monitoring cloud services, databases, hosts, and containers (to name a few) vital information and insight into their business can quickly become disjointed and convoluted.

New Relic can help. It puts all the information across the organization into one, comprehensive, and clear platform. New Relic's technology allows companies to quickly pick up on trends and relationships in their data to grow and optimize their business. The software works across all devices so that customers can access information wherever it is most convenient for them.

Since it streamlines over 220 integrations and offers unique programmability, clients can build a customer application to easily access what's most important for them and the individual needs of their business.

Challenges and Prognosis for New Relic

New Relic’s capabilities and user-friendly software made it one of the fastest-growing companies for the majority of the past six years. They made the unusual decision to place their engineering department in Portland to attract the talent of their CTO, Jim Gochee. Despite Portland’s small technical scene, it still managed to have what appeared to be limitless growth.

However, all of this changed in August.

Jim Gochee resigned shortly after New Relic announced that the sales forecast for the year was below $593 million. This forecast was a blow for the company, as it initially forecasted its sales at $600 million. Shares plummeted 30% in the wake of their announcement, and the company has struggled to come back from that loss.

Their space in Application Monitoring is highly competitive, and they are up against other publicly traded companies such as Appdynamics (a Cisco company) and Dynatrace. They also have competition with other companies such as Datadog and SignalFX (acquired by Splunk).

However, they also have competition against the very companies that could be their clients. Organizations sometimes choose to build their own app monitoring solution.

Would it appear that New Relic has reached its ceiling in terms of growth? Not so fast.

New Relic indeed has some work ahead of them. With a better understanding of the market and their prospects' needs, though, there is still incredible potential for the company. They can expand their market share with a deeper understanding of their customer before they reach out to them.

Intricately Analysis

Intricately provides this very kind of much-needed analysis.

We provide detailed insights into more than 10 million organizations around the world and product usage intelligence on more than 21,000 cloud products.

Here at Intricately, we collect all of our data from the public internet and are not in-line from a traffic perspective. Our customers do not provide us with any usage data. Instead, we monitor publicly available products and accessible products and infrastructures. Our sensors are also able to monitor the public components to many products that are on-prem and behind a firewall.

Intricately analyzed New Relic's customer base to find key trends and offer competitive insights to help inform future growth strategy.

Insights into New Relic’s Customer Base

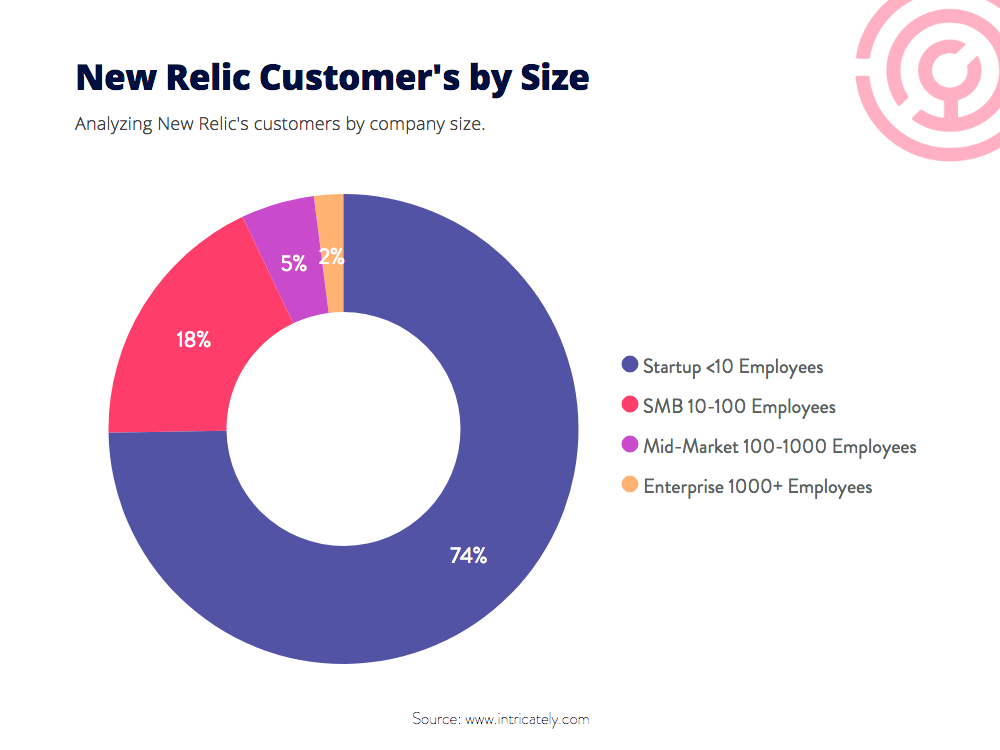

Currently, New Relic's most extensive customer base is start-ups. They make up 74% of the company's total customer base. This makes sense since start-ups do not typically have the resources or the IT department to dedicate to creating their own app. However, they still have a complicated structure that needs New Relic's much-needed insight and simplicity.

Likewise, small and medium-sized businesses (SMBs) are their next largest customer base, comprising about 18% of their customers.

Geographically, New Relic’s largest presence is in the European, Middle Eastern, and African market. They make up 38% of their clients. The North American market follows closely, making up 32% of their market.

The average amount that their customers spend on the cloud tends to be lower as well. The majority of their clients, almost 52%, spend less than $1000 a month on the cloud. The next largest segmented, a little over 32%, spend between $1-10K a month.

New Relic’s Total Addressable Market

Companies that have a sophisticated infrastructure need a product like New Relic's to be successful. That is why we identified customers with this intricate structure by analyzing the total number of applications that these companies run.

The more apps that they use, the more they need New Relic to unite them for better business.

We found that there is a vast market in North America that could use New Relic and represent a potential customer base for them. Over 2 million companies use up to 10 applications, which means they could possibly use New Relic. However, almost 200,000 use between 10-50 apps, which makes them a potential market. Also, over 15,000 use between 50-100 and more than 2,000 use over 500 apps.

New Relic has far from reached its ceiling. Organizations need more infrastructure in order to grow, and these all create potential clients for New Relic.

We also identified a potential market for New Relic based on Points of Presence (PoPs). As expected, Enterprises have multiple PoPs in both data centers and the cloud because of their large IT structure and immense needs.

However, even start-ups are facing increasing complexities that make them the ideal target for New Relic's software. The average start-up has as many PoPs in both Data Centers and the cloud as SMBs.

Cloud growth has made New Relic more relevant than ever and only increases the demand for their product.

Summary

New Relic has faced recent challenges that require a better analysis of their market to overcome. Between competition, the latest vacancy of their CTO and downturn in their forecasted sales, they face some difficulties.

However, it doesn't have to be an uphill battle in order to keep their growth on track. As this report illuminates, there is still a large potential market that New Relic can breakthrough. Literally hundreds of thousands of business in the US alone could use their product. As start-ups grow more complex, the demand for its product continues to grow.

With a better understanding of their market and their customer’s needs, New Relic can enjoy more growth and start smashing through its projected forecast again.

Where We Sourced this Data

We sourced the data for this report here at Intricately through our sensors. We monitor the adoption, usage, and spend on 21,000 distinct cloud products used by more than 7 million companies from around the world. Our Global Sensor Network deploys more than 150 PoPs to get a comprehensive view of how companies deploy, utilize, and invest in their digital products and applications. Click here to see a list of the products we monitor.

We hope you enjoyed this report. We help leaders across cloud marketing and sales organizations forecast, prioritize, and close opportunities faster with our Enterprise Platform.

Let our team give you a demo of our product today! In the meantime, get some insights with our data using our free web app.

Note: The data in this report has been collected via Intricately’s proprietary Global Sensor Network. We evaluated seven million companies and monitored more than 21,000 unique cloud products.

3 Trends Shaping the Evolving Cloud Hosting Market

4 Ways Cloud Marketing Leaders Can Get the Most From Their Budgets in 2022

How to Perform Account Segmentation and Prioritization

How Qualys Will Continue To Grow In 2019

Introducing Intricately's Account-Based Academy: Using Data To Accelerate Your Go-To-Market Strategy