back to all posts

back to all posts

Salesforce's Acquisition Of Tableau: A Data Analysis Of The Newest Addition

Salesforce just dropped the big bucks to acquire data-visualization platform Tableau in an all-stock transaction worth $15.7 billion. Tableau has been a Salesforce’s acquisition target since 2016, but Google’s recent grab of Looker (for $2.6 billion) appears to have applied the necessary pressure for Salesforce to shell out $9.2 billion more than their most recent mega-acquisition of MuleSoft just last year.

This expensive move shows just how ambitious CEO Marc Benioff is about evolving Salesforce into a sprawling software supermarket like that of Microsoft or Oracle. Currently, Salesforce is planning to launch a unified customer experience with Salesforce Customer 360—their customer data integration product that’ll make B2C service, marketing, and commerce work together seamlessly. And now, with the purchase of Tableau, customers will have the business intelligence tool they need to see, understand, and take action on their massive amounts of data.

“We are bringing together the world’s #1 CRM with the #1 analytics platform. Tableau helps people see and understand data, and Salesforce helps people engage and understand customers,” said Marc Benioff in a statement. “It’s truly the best of both worlds for our customers–bringing together two critical platforms that every customer needs to understand their world.

Tableau has been one of the leading business intelligence tools for years now. With only a little over ⅓ of their deployments are in the cloud, there exists an exceptional upsell/cross-sell opportunity for Salesforce to market their 360 cloud suite to Tableau’s existing data enthusiasts. Data enthusiasts who’ve primarily been using Tableau in an on-premise data center and could be convinced to migrate and manage their business in the cloud.

To learn more about Salesforce and Tableau’s unique and shared customers, we dive into the data collected from our proprietary sensor network. These monitors are positioned around the digital globe to observe cloud spend and adoption of cloud products by businesses big and small. Take a peek into what we discovered...

A Customer Base Primed for Upsell Opportunities

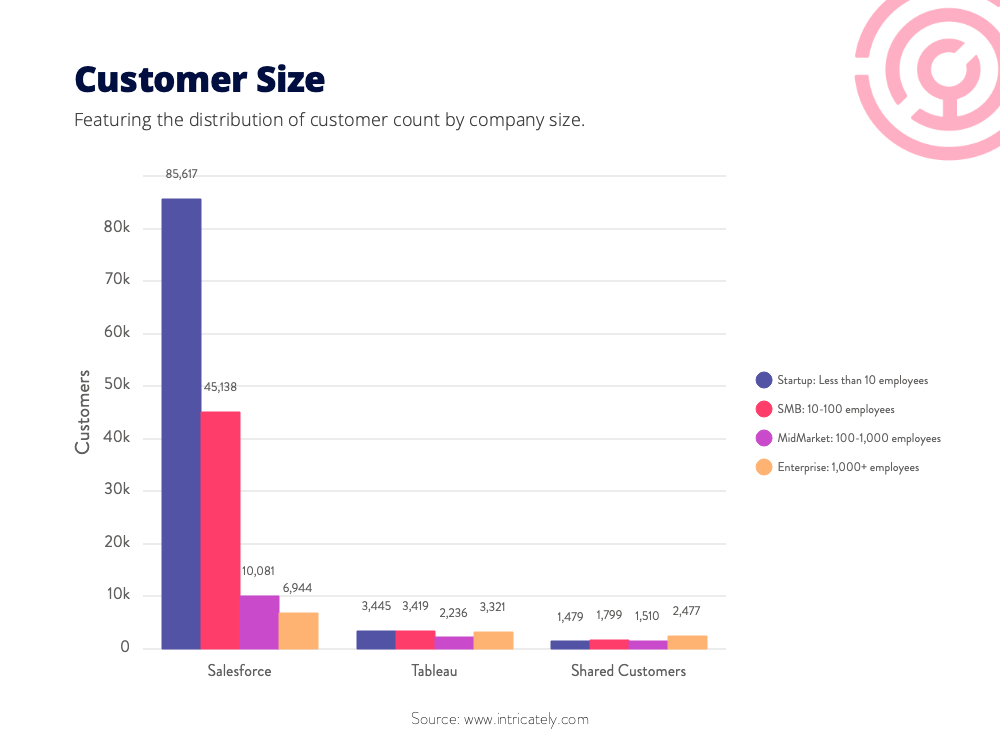

Intricately’s global sensor network uncovered insights into 146,924 of Salesforce customers and 12,527 of Tableau customers. Of these, the companies share 7,255.

Most of Salesforce’s customers are startups and SMBs, while Tableau has a pretty equal balance of customers between startup to enterprise size. Most of the companies shared customers fall into the enterprise category, leaving a lot of room for upsell across the other markets.

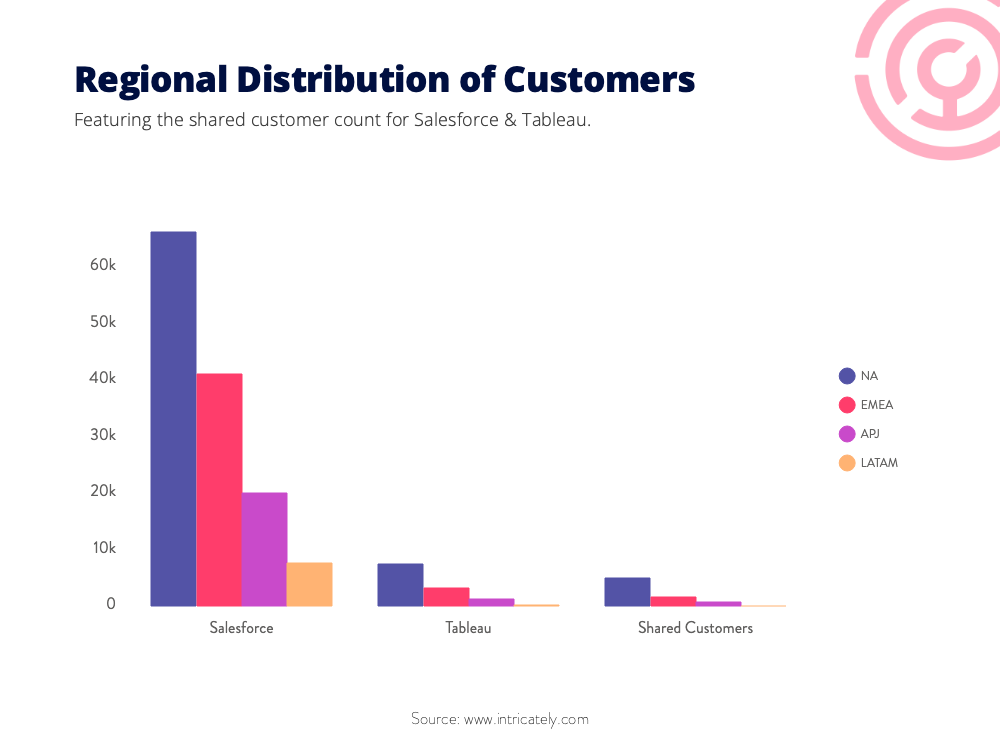

North America contains both companies largest customer base, with EMEA falling in second place, and LATAM being the smallest.

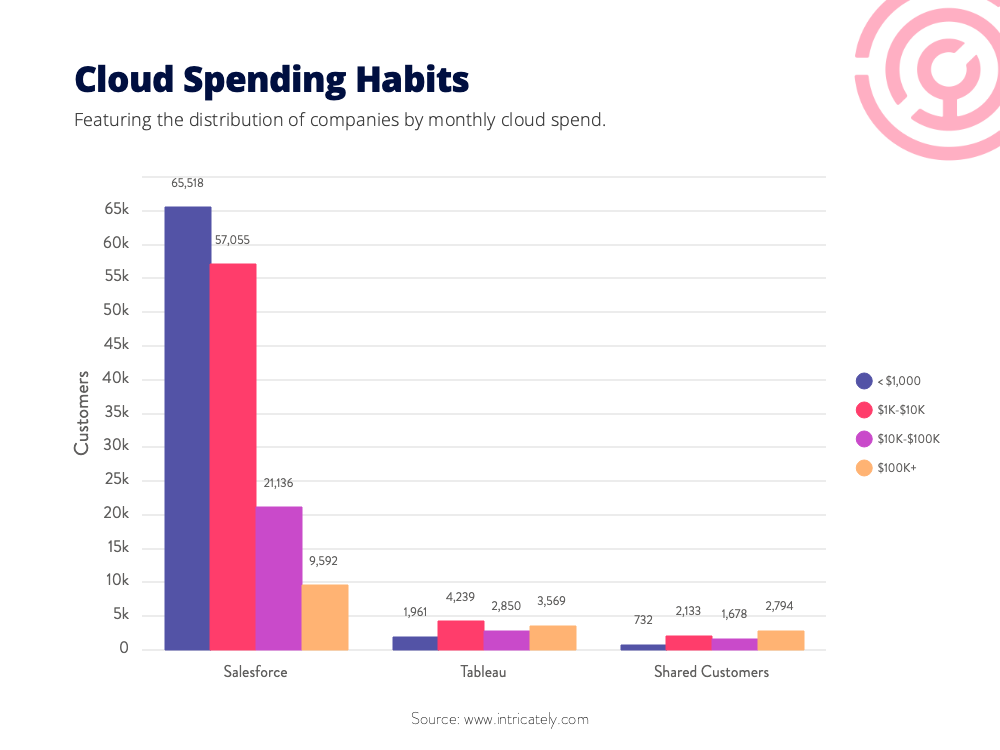

The bulk of Salesforce clients are spending less than 10K, while the majority of Tableau's are spending more than 10K. When it comes to shared customers, the largest category is the heavy 100K+ spenders.

If you're curious to learn more about how this data is collected, contact us to learn more.

This chart illustrates some fantastic upsell potential for Salesforce. Customers using both products already are, on average, outspending other customers. By bringing both tools together and cross-selling, Salesforce is in a prime position to move more customers from the 10K-100K bracket into the 100K+ spending range. For example, Salesforce could immediately target the 4,300 Tableau clients who spend over 10K/mo on data center hosting and offer their Heroku product (along with a number of others). This is just a single example of many cross-selling opportunities.

Salesforce has a myriad of cloud products, and here are the solutions Intricately monitored for customer adoption. Salesforce CRM solution has the most popular adoption, which makes sense given it’s arguably one of the most powerful CRMs on the cloud. It’s followed by Heroku, a platform as a service (PaaS) that enables developers to build, run, and operate applications entirely in the cloud.

This data shows how deeply Salesforce’s customers have adopted the cloud. See below for definitions of sophistication:

- Cloud Leader: At least one of the leading Cloud providers are deployed. Leading Cloud providers include AWS, Azure, Alibaba, and GCP.

- Cloud Laggard: A Cloud provider is being used but no Leading Cloud providers are deployed and no Data Center solutions are deployed.

- Data Center: A Data Center solution is deployed exclusively. There are no Cloud providers deployed.

- Hybrid: There is a combination of Data Center and Cloud providers deployed.

- None: There are no infrastructure hosting providers in place.

Want more data where that came from? We have insights into how millions of global companies are using over 21,000 cloud products. Yeah, that’s a lot of data. Sign up for a free Intricately account now and discover cloud adoption and spend for practically any company you can think of. Go ahead—give it a try!

If you're curious to see a breakdown for your company, contact us to schedule a consultation.

3 Trends Shaping the Evolving Cloud Hosting Market

4 Ways Cloud Marketing Leaders Can Get the Most From Their Budgets in 2022

How to Perform Account Segmentation and Prioritization

6 Actionable Takeaways for Cloud Marketing and Sales Professionals from Intricately's Selling in the Cloud Podcast

Introducing Intricately's 2021 State of the Cloud Security Market Report