back to all posts

back to all posts

How Cloud Sellers Can Capitalize on 2020 Regional Growth in the Gaming Vertical

The gaming market is growing worldwide, with estimates that the global number of players will surpass the three-billion mark by 2023 – at which point the market is also projected to surpass $200 billion in revenue. Growing demand among gamers in regions like APAC, EMEA, and LATAM present opportunities for cloud vendors to provide services to gaming companies to meet these needs.

According to Cisco, global gaming traffic will reach 11.0 Exabytes per month in 2021, up from 1.2 Exabytes per month in 2016. The shift toward streaming and cloud gaming was increasing IT infrastructure capacity needs before the COVID-19 pandemic, but the trend has accelerated with more people staying at home.

IT vendors have a major opportunity to fill the gaps between 1) where fast-growing businesses have usage and 2) where they currently have hosting PoPs.

Read on to learn how cloud vendors can capitalize on the regional growth of selected gaming businesses, or download our full 2020 State of the Gaming Vertical Report here.

Regional Growth of Selected Fast-Growing Gaming Businesses

From a supply (infrastructure) and demand (users) perspective, the growth in worldwide adoption of gaming must correlate to a growth in cloud hosting providers across up and coming regions if user experience quality is to remain competitive.

The regions in which businesses have the greatest demand but least amount of infrastructure represent the greatest opportunity for cloud hosting providers.

Significant geographic opportunity areas for infrastructure providers exist outside of North America and EMEA. Regions like LATAM and APAC have growing consumer usage and are currently without sufficient IT infrastructure to support that growth, presenting an opportunity for cloud sellers.

Let’s take a look at some examples of fast-growing gaming businesses who represent opportunities for global cloud sellers.

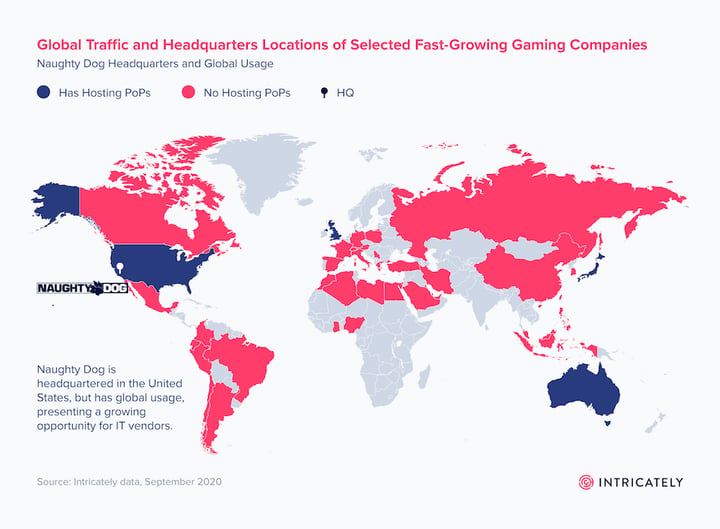

Naughty Dog

Naughty Dog is a rapidly growing game developer headquartered in Santa Monica, CA – has widespread usage in regions like LATAM and EMEA where they currently have no (or insufficient) hosting PoPs.

OrangeGames

Headquartered in Schiphol, Noord-Holland, The Netherlands – Orange Games focuses on gaming, publishing, distribution, and advertising. They have offices in Amsterdam, Berlin, Tel Aviv, and Istanbul – but as you can see in the map above, some of their high-traffic countries do not currently have hosting PoPs (e.g. parts of LATAM and APAC). Cloud providers who can bridge that gap will have immense value to offer the business.

Contact Intricately for detailed usage, spend maps, and actionable data on any gaming company.

How Cloud Vendors Can Capitalize on Opportunities Within the Gaming Vertical

There are a wide array of ways for cloud providers to offer value to fast-growing gaming companies. Here are a few:

Help businesses scale through cloud technology

“Cloud computing in gaming allows companies to scale up or down depending on their needs… Additionally, in turn, [it] saves more valuable financial resources to funnel into research, new developments and other innovations that enrich the gaming experience.”

Hind Naser at Vexxhost

Create “lag-less” gameplay

“Companies building and renting servers spaced around the world would mean everyone uses local servers. At that point, you’d probably reach a lag-less gameplay perfection.”

Angelo M. D’Argenio at Gamecrate

Enable businesses to reach gamers on any device

“Rather than depending on gaming consoles like Playstation or Xbox, cloud computing in gaming supports a wider range of devices from laptops, tablets, smartphones and beyond… therefore providing an exceptional gaming experience for anyone who has a connection to the internet, no matter what device they are using.”

Hind Naser at Vexxhost

Knowing these opportunity areas can help vendors more easily spot businesses who are in the early stages or who may not yet realize the challenges they’re facing. If you can utilize out-of-country or regional growth data to identify these businesses, you can approach them ahead of the competition.

Let Intricately help you find the next opportunities for cloud vendors within the gaming vertical. Contact us to learn more.

3 Trends Shaping the Evolving Cloud Hosting Market

4 Ways Cloud Marketing Leaders Can Get the Most From Their Budgets in 2022

How to Perform Account Segmentation and Prioritization

The Future of Cloud Computing: 3 Market Predictions for 2022

Enterprises Leading the Edge Computing Market in 2021