back to all posts

back to all posts

How Dynatrace Can Win The APM Market

The cloud is dynamic, cutting edge, and full of endless opportunities with hundreds of different technologies.

However, that also means that it can be complicated. For businesses, all of the exciting potential means nothing if they can't understand what their technology means or how to use it to benefit themselves and their customers.

For Dynatrace, the answer to this complexity is Artificial Intelligence. The Application Management Software (APM) company does much more than simply monitor applications for business. It also offers AI for operations, digital experience management, and cloud infrastructure monitoring.

Dynatrace gives businesses the chance to monitor every aspect of their business, both on-premises and in the cloud. The create better organizations by managing the performance and availability of software applications, as well as their impact on user experience. With monitoring and tracing features, they allow companies to harness technology to improve their business.

The company was founded in 2005, but it was when Thoma Bravo acquired in 2014 that leaders were truly invigorated to utilize the cloud for their business.

Dynatrace went public in August 2019. It currently leads the market over its competitors, most notably AppDynamics and New Relic. With a valuation of $6.7 billion, the company has made impressive headway as a new IPO.

However, their growth has noticeably stalled in the past year. This is mostly due to the transition of customers from licensed software model to a cloud subscriptions. The operational costs required to shift the model caused a $116 million net loss for 2019, compared to a $9.2 million profit in 2018.

Although Dynatrace still leads the market, competition is fierce. AppDynamics, which was bought by Cisco just days before going public themselves, is catching up quickly to the company and outpaced Dynatrace in growth last year.

Dynatrace’s Prognosis

While Dynatrace faces incredible competition, both the company and its competitors have barely scratched the surface of their potential.

With penetration in the single digits, these companies have an incredible opportunity for growth. This is Dynatrace’s chance to swoop in and quickly outpace its competition.

If Dynatrace truly starts to understand its market and spread its reach to new customer bases, they can have unprecedented growth. Although their shift to the cloud created costs, it also made remarkable opportunities in new markets.

By finding out who they need to market to, Dynatrace can recover their costs and grow bigger than ever.

Intricately Analysis

How can Dynatrace find new markets and opportunities? Here at Intricately, we can help.

We created the data in this report using our proprietary Global Sensor Network. The network collects data on digital product usage, application, and traffic. This data provides detailed insights on more than seven million businesses worldwide and the product usage intelligence on over 21,000 cloud products.

We collect data from the public internet and are not in-line from a traffic perspective, nor do our customers provide us with any usage data. We can monitor publicly-accessible products and infrastructure. In addition, many on-prem and behind-firewall products have public components to their products, which our sensors can monitor as well.

We analyzed Dynatrace’s customer base to identify key trends and competitive insights to inform future growth strategy.

Dynatrace’s Customer Base: Where They Succeed

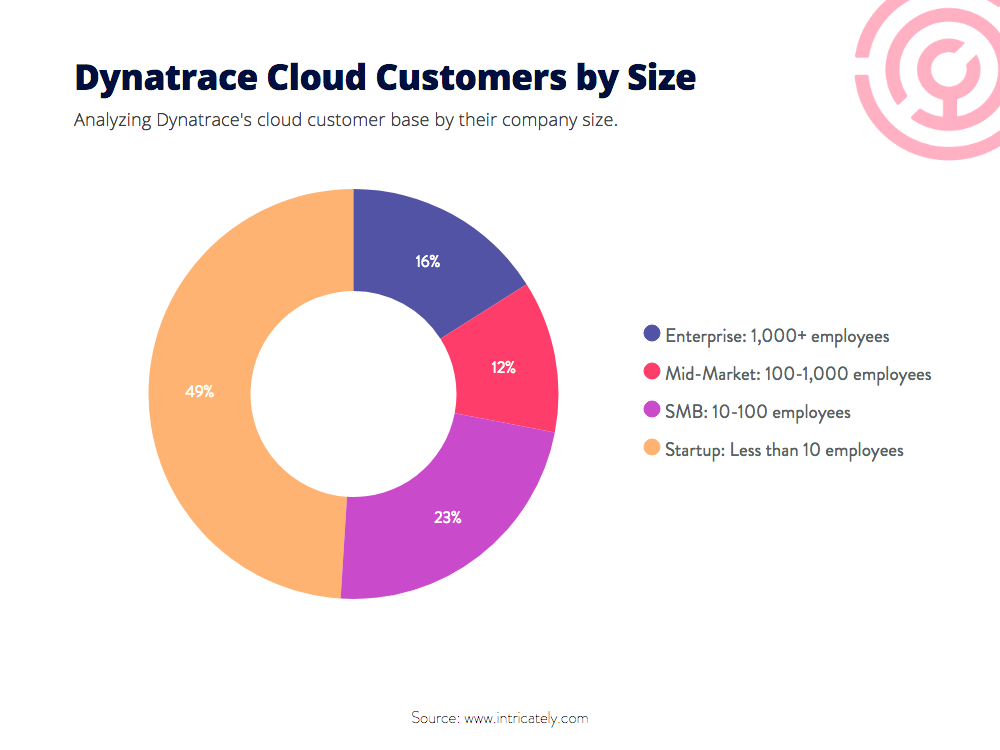

Currently, Dynatrace's market is with the start-up sector. Start-ups make up about 49% of their current customer base. The next largest are small-to-medium-sized businesses (SMBs), which make up around 23% of their customers.

Their smallest customer base is with mid-market businesses, which is currently at 12%.

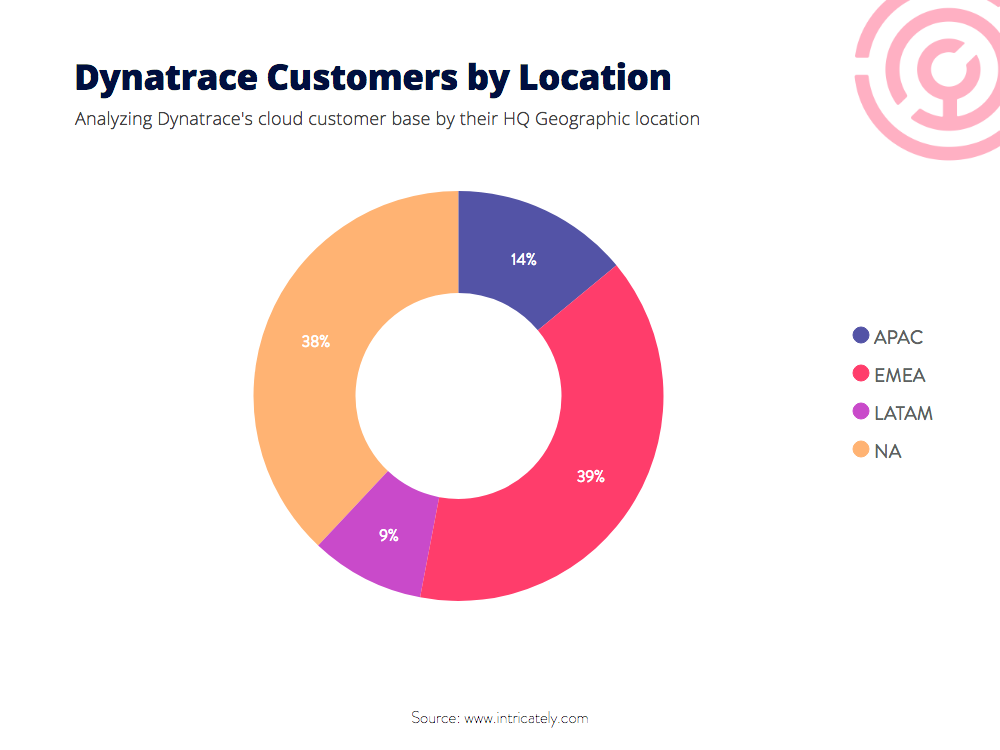

Geographically, Dyntrace’s largest market is Europe, which makes up 39% of its customers. They are followed very closely by North America, though, which is 38% of its customer base.

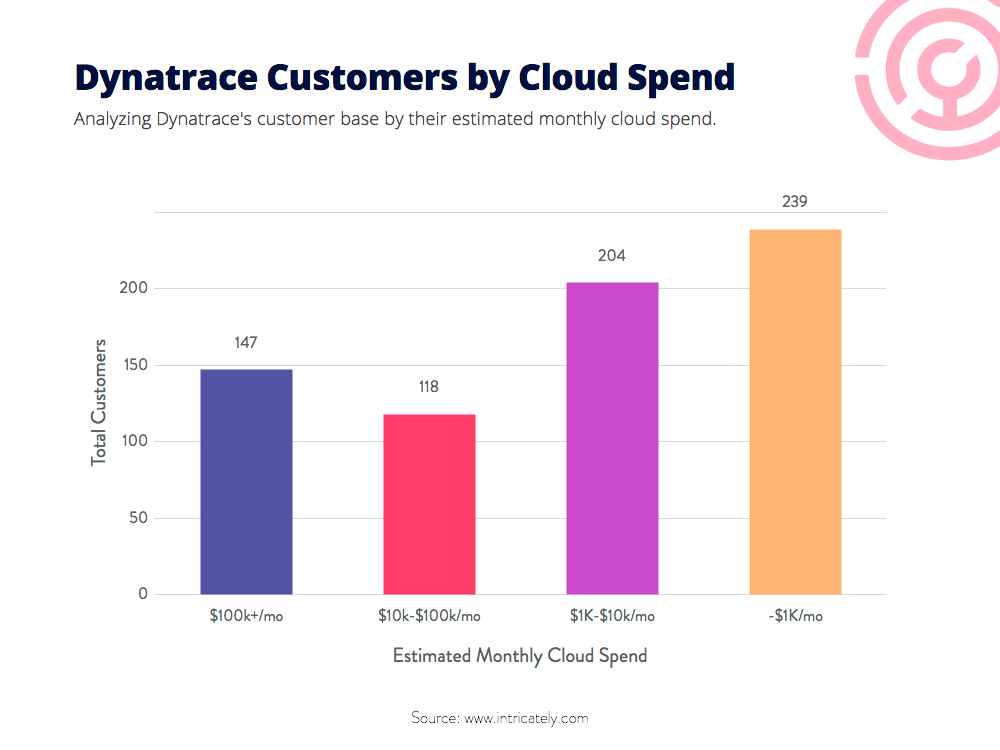

Because their current customers are small businesses and start-ups, they don’t typically have a high cloud spending budget. The largest majority of their customers (about 34%) spend under $1,000 a month on cloud technology. The next largest segment of their customers (29%) spend between $1,000-10,000 monthly on their cloud products and services.

Potential Customer Base: Where They Can Grow

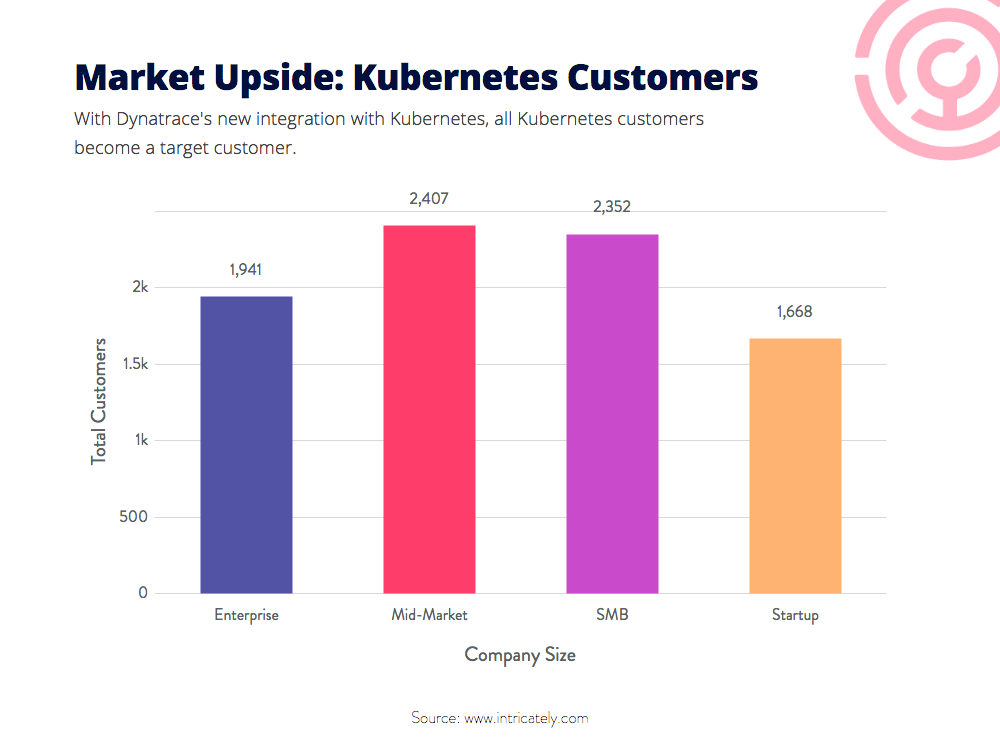

Kubernetes offers an incredible opportunity for businesses: their open-source coding allows organizations to share and get the top cloud technology. However, it can also easily be disorganized and confusing for companies. Dynatrace offers the perfect way for these businesses to monitor all of their information in one convenient place.

Kubernetes' customer base holds an excellent opportunity for the company. It's interesting to note, though, that the most extensive customer base for Kubernetes is mid-market businesses and followed closely by SMBs. Start-ups, which are typically the largest market for Dynatrace, make up the smallest part of Kubernetes customer base.

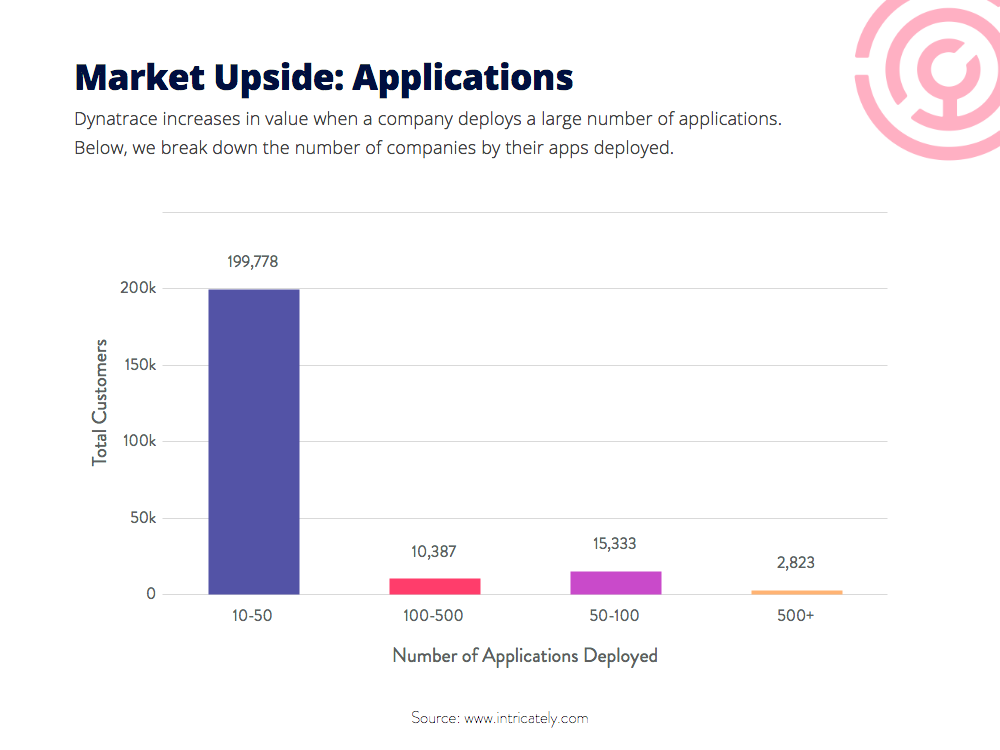

In addition, Dynatrace has great opportunities amongst businesses that use multiple applications. It can help them organize and understand their data to make informed decisions. Millions of companies in North America use up to 10 applications, which Dynatrace could potentially help. Almost 200,000 companies use up to 50 applications and could use a monitoring system. Also, over 28,000 organizations around North America use over and beyond that.

It’s safe to say that there are untapped potential markets for Dynatrace to explore.

Summary: Dynatrace’s Unlimited Potential

Dynatrace CEO John Van Siclen states they currently work with 2,400 customers. According to our analysis, they have opportunities to work with hundreds of thousands more. While Dynatrace has yet to gain on their investment into shifting from licensed software to cloud subscription, they are poised to surpass the competition in the near future.

However, Dynatrace must understand exactly who their market is. Although they traditionally work with small businesses and start-ups, their most significant potential customer base is mid-market. Unless they adjust, they run the risk of falling behind and their competition could find this valuable market.

The company would do well to adjust their marketing and selling strategy to reach mid-market organizations.

Where We Sourced This Data

Here at Intricately, we monitor the usage of over seven million companies and analyze the usage, adoption, and spend on 21,000 distinct cloud products. Our proprietary Global Sensor Network deploys more than 150 points of presence to get a comprehensive view of how companies deploy, utilize, and invest in their digital products and application. Click here to see a list of products we monitor.

We hope you enjoyed our report. With the help of our Enterprise Platform, leaders across cloud marketing and sales organizations can forecast, prioritize, and close opportunities faster than ever. Let our team give you a demo of our product today! In the meantime, use our free web app to get access to some of our data.

Note: Intricately’s proprietary Global Sensor Network gathered the data in this report. Over seven million companies were evaluated, and 21,000 unique cloud products were monitored.

3 Trends Shaping the Evolving Cloud Hosting Market

4 Ways Cloud Marketing Leaders Can Get the Most From Their Budgets in 2022

How to Perform Account Segmentation and Prioritization

4 Ways Cloud Marketing Leaders Can Get the Most From Their Budgets in 2022

Evaluating Your Total Addressable Market (TAM): Why It's Key for ABM