back to all posts

back to all posts

CDN Industry: Trends, Size, And Market Share

Between 2020 and 2025 the cloud CDN market is expected to grow at a compounded annual growth rate of 28%.

Increased demand for content, particularly streaming video, among consumers has put pressure on publishers, developers and cloud providers to continuously improve digital experiences. CDN providers are challenged to bring servers closer to consumers and deliver content at high, reliable speeds.

Every year, Intricately releases an analysis report based on the data we gather on the CDN Market. (Check out our 2019 CDN Report and all recent cloud market reports). This year’s upcoming report features comprehensive data from the past 18 months on CDN usage, plus the trends and insights that are driving the most change in the industry.

How COVID-19 Has Impacted CDN Market Share and Trends

Prior to the global pandemic, the CDN market was already on pace for a growth year, however COVID-19 has shifted the market landscape and accelerated demand for content delivery.

With stay-at-home orders, at-home digital content consumption increased drastically. Nielsen reported that:

- The percentage of time spent online on mobile devices accessing current events and global news year-over-year in the US has increased 215%.

- Daily Twitch viewership in the U.S. more than doubled in Q1 2020.

- The amount of streaming grew by 1 billion hours across internet-connected devices between March and May.

This uptick in consumption is driving demand for more CDN infrastructure. Consumers are increasingly streaming not just for traditional entertainment media, but also for growing categories like online fitness and wellness, online gaming and cooking.

Consumers are eager for new apps, games and experiences. Companies that sell digital products are moving fast to meet their demands, and CDNs are right in the middle.

CDN Market Share Trends: Top CDN Providers

CDNs are segmented by the types of services they provide, the end-users they target, and the geographies they serve.

Many companies that are using a CDN require multiple CDN providers because they will have different needs that a single CDN is not often able to provide.

CDN Market Trends Point to Global Providers

A vendor may choose a CDN provider with presence in North America and Europe for their needs in those regions, while choosing another local vendor elsewhere. As small businesses scale, availability and redundancy become top of mind. A multi-CDN strategy enables companies to load-balance, mitigating risk of inefficient traffic flows or outages.

While CDN providers often have different target customers, companies are using multiple CDN vendors at the same time, sometimes leveraging pricing in contract negotiations to keep costs down.

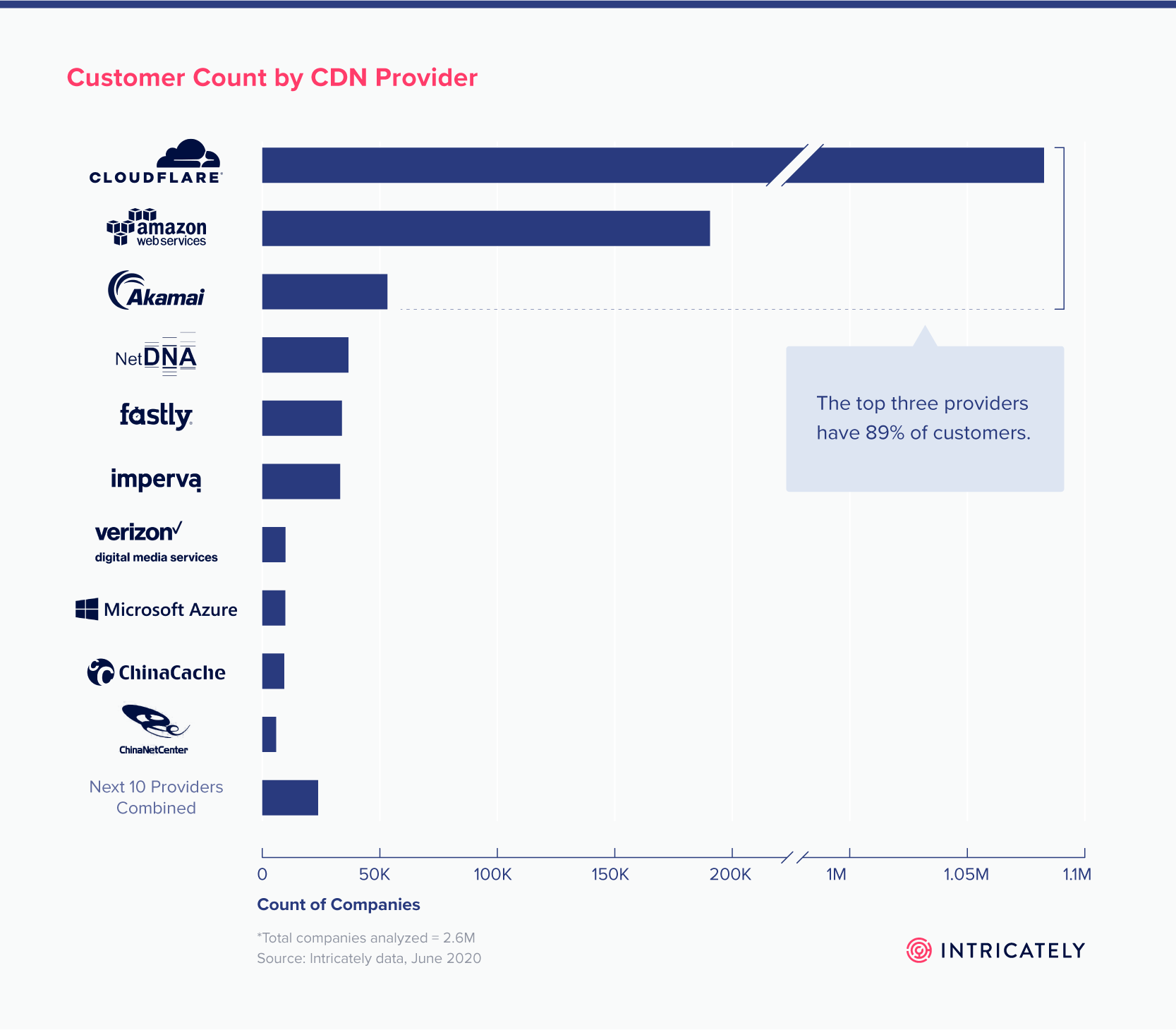

The top CDN providers by customer count are Cloudflare, Amazon Web Services (AWS), Akamai, NetDNA, Fastly, Imperva, Verizon, and Microsoft Azure.

On the surface, Cloudflare appears to be the biggest CDN by its customer count. Cloudflare provides CDN services to over 1 million customers. Though it has a large customer base, this value doesn’t tell the whole story.

Cloudflare has less than 10,000 mid-market and enterprise customers; the majority of its customers are mid-market and SMB. Many of its customers use Cloudflare’s services to speed up websites, but also to improve security.

While Cloudflare and AWS CloudFront have the most customers by count, Akamai has more enterprise customers.

Akamai has been a CDN market leader since the 1990s. With at least a decade more in business than many of its competitors, it is significantly ahead of other CDN companies in terms of revenue. Akamai owns upwards of sixty five to seventy percent of the market in revenue. Most of that revenue comes from its large-scale enterprise partners.

Between Cloudflare, AWS, and Akamai, Akamai is the only provider that has more enterprise level than mid-market customers. Akamai may have fewer customers, but their customers are major users with heavy traffic. About half of Fortune Global 500 companies use Akamai. Last October, it set a CDN traffic record with 106 Tbps during the rollout of a Fortnite Chapter 2 update.

CDN market share is diversifying: Customers using a combination of bundled products and outside providers

AWS may be a leader in the cloud—but its approach with CDNs is different than other vendors. They offer affordable CDN infrastructure as part of the on ramp to get to other higher-yield services.

Many companies use multiple vendors to suit their content delivery needs. Nearly a third of AWS customers are also Amazon CloudFront customers. In contrast, less than 10% of Microsoft Azure customers also use Azure CDN.

CDN Pricing Comparison and Spend Data

Some companies spend millions of dollars on CDN providers each year, but most (even mid-market organizations) spend orders of magnitude less.

The vast majority of mid-market companies and enterprises spend less than $1,000 a month on CDN products. Less than 700 companies spend more than $100,000 monthly on a CDN.

For the larger spenders, CDN spend is likely to be diversified across multiple providers in different geographies. As companies grow in CDN spend, their expectations for high-quality service and support also scale.

Final Takeaways: CDN Market Share and Trends

Taken altogether, the 2020 CDN market is growing — and is poised to continue growing for the foreseeable future. CDN providers have the opportunity to grab additional market share by serving specific use cases and customer profiles. Companies like Limelight Networks and Fastly continue to succeed by focusing on their respective targets.

For a more detailed breakdown, stay tuned for our upcoming 2020 CDN Report in August. Looking for more data now? Check out our cloud market reports.

3 Trends Shaping the Evolving Cloud Hosting Market

4 Ways Cloud Marketing Leaders Can Get the Most From Their Budgets in 2022

How to Perform Account Segmentation and Prioritization

How Today’s CDN Vendors Compete With Specializations

How Increased Content Consumption During COVID-19 Is Driving 2020 CDN Market Growth