back to all posts

back to all posts

5 Cloud Market Trends Shaping The Industry In 2020

Despite increasing volatility in today’s global economic landscape, 2020 remains on pace for another record year of cloud application growth. Gartner predicts that public cloud revenue will grow by 17% in 2020.

What trends are influencing the exponential growth of cloud hosting products worldwide? Find out in the 2020 Cloud Hosting Report.

Intricately analyzed seven years of historical data on cloud hosting environments and providers worldwide to pinpoint the patterns that will shape the market in 2020 and beyond.

Keep reading for a sneak peek into the cloud market trends you’ll find in the report. And make sure to download the full report for even more insights and rich data visualizations.

Download the 2020 Cloud Hosting Report

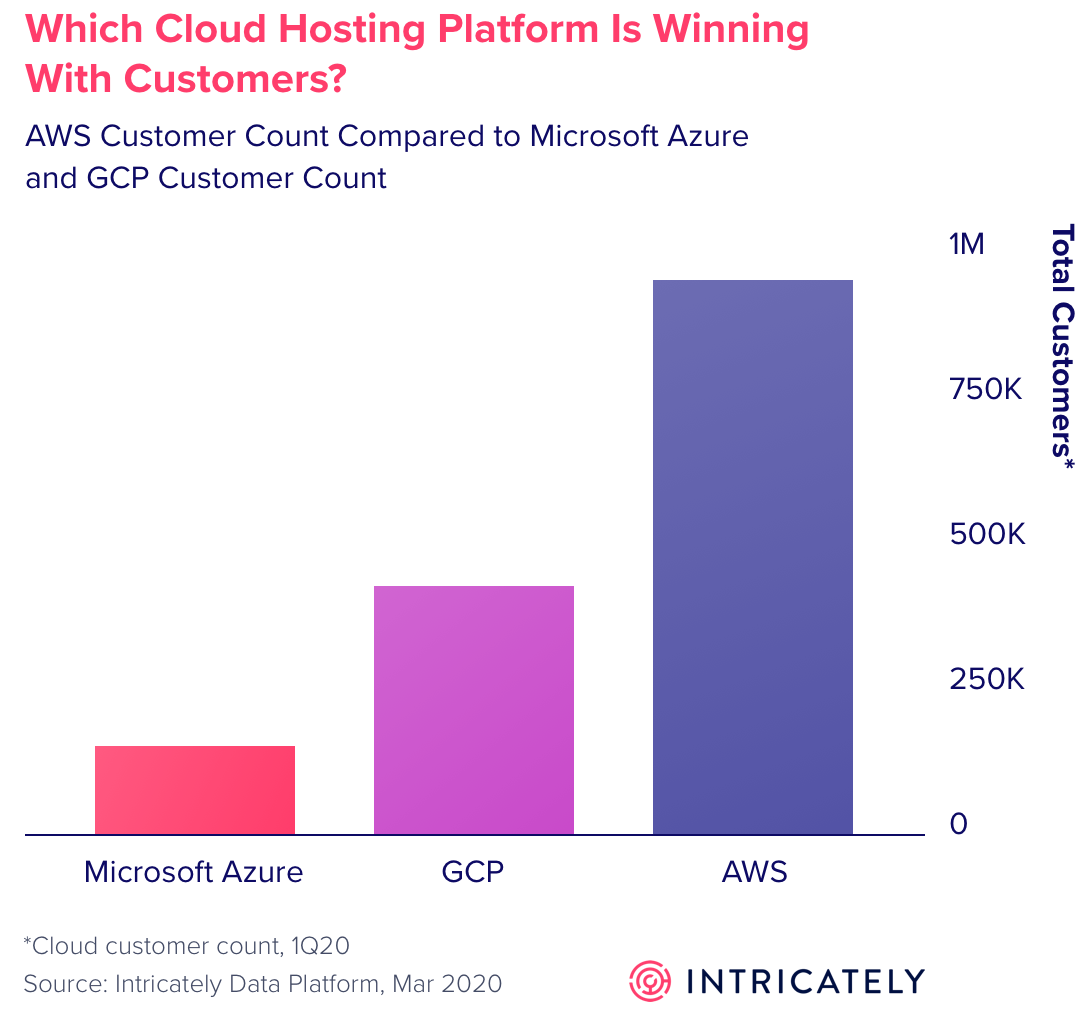

Trend 1: AWS Dominates the Cloud Hosting Market

AWS, Microsoft Azure, and Google Cloud Platform (GCP) remain the three largest cloud hosting providers. Yet AWS is growing revenue and customer count at a faster rate than competitors. AWS reported $9.95 billion in cloud revenue in the last quarter of 2019 alone.

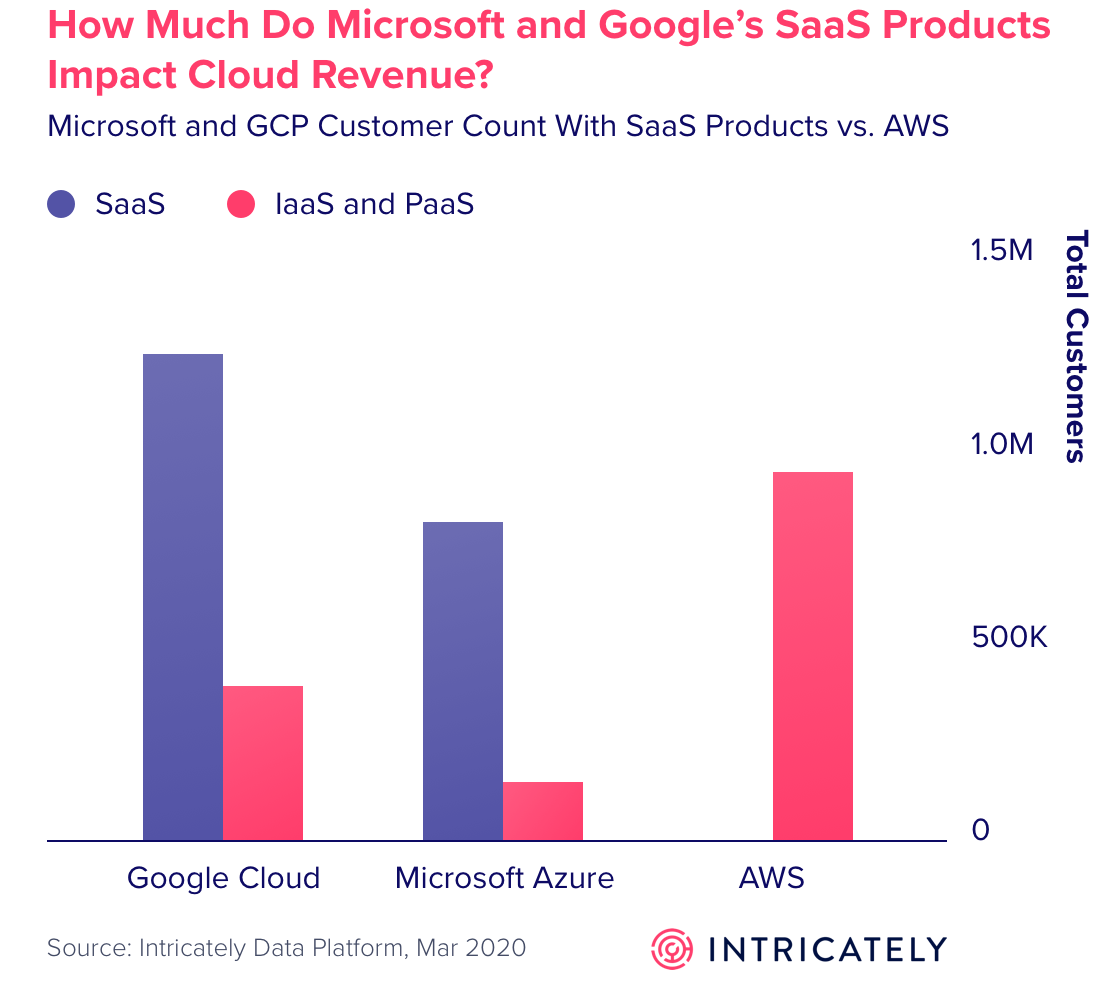

Trend 2: Microsoft and Google Rely On SaaS to Drive Cloud Utilization

Microsoft and GCP deploy low-cost SaaS solutions with the hopes it will lead to stickier, higher-margin IaaS and PaaS purchases.

According to reports, Google Cloud generated $2.61 billion for the quarter, but that number includes both GCP and G Suite. Meanwhile, Microsoft reported $12.5 billion in combined cloud revenue, which includes SaaS (Office 365, Dynamics, etc.) and cloud computing (Microsoft Azure).

In the same calendar quarter, AWS surpassed GCP’s quarterly cloud revenue nearly five times with its IaaS and PaaS products alone. Amazon reported just under $10 billion in cloud revenue, putting them far ahead of Google and Microsoft for cloud hosting market share.

The most lucrative product category is IaaS & PaaS products, which AWS remains the leader in.

Trend 3: Customer Spending Will Continue to Grow Among Top Providers

Business dollars are continuing to shift from physical on-premises assets to shared cloud assets. Gartner forecasts IaaS to grow 24% year over year in 2020, which is the highest growth rate across all market segments.

Despite cloud computing’s massive influence in the technology space, cloud spending only represents 5.6% of total IT spending, which is on track to hit $3.8 trillion this year. If only 20% of enterprise workloads have moved to the cloud, we expect massive growth to come.

Download the 2020 Cloud Hosting Report to see which 10 cloud providers have the largest share of enterprise customers.

Trend 4: Microsoft Azure And GCP Face Significant Challenges Catching AWS By Organic Growth

In 2019, validation that organic growth might not be enough to catch a cloud leader was demonstrated by several of the top companies in the cloud hosting space.

Recent big moves include:

- IBM acquired Red Hat for $34 billion last year to expand its multi-cloud platform.

- Microsoft and Oracle recently announced a cloud partnership that connects Azure services to Oracle Cloud services.

- In December 2019, Microsoft won a $10 billion technology contract with the Department of Defense, a deal that IBM, Oracle, Amazon, and Google were also after. The contract puts Microsoft in a prime position to earn the estimated $40 billion that the federal government will spend on cloud computing over the next few years.

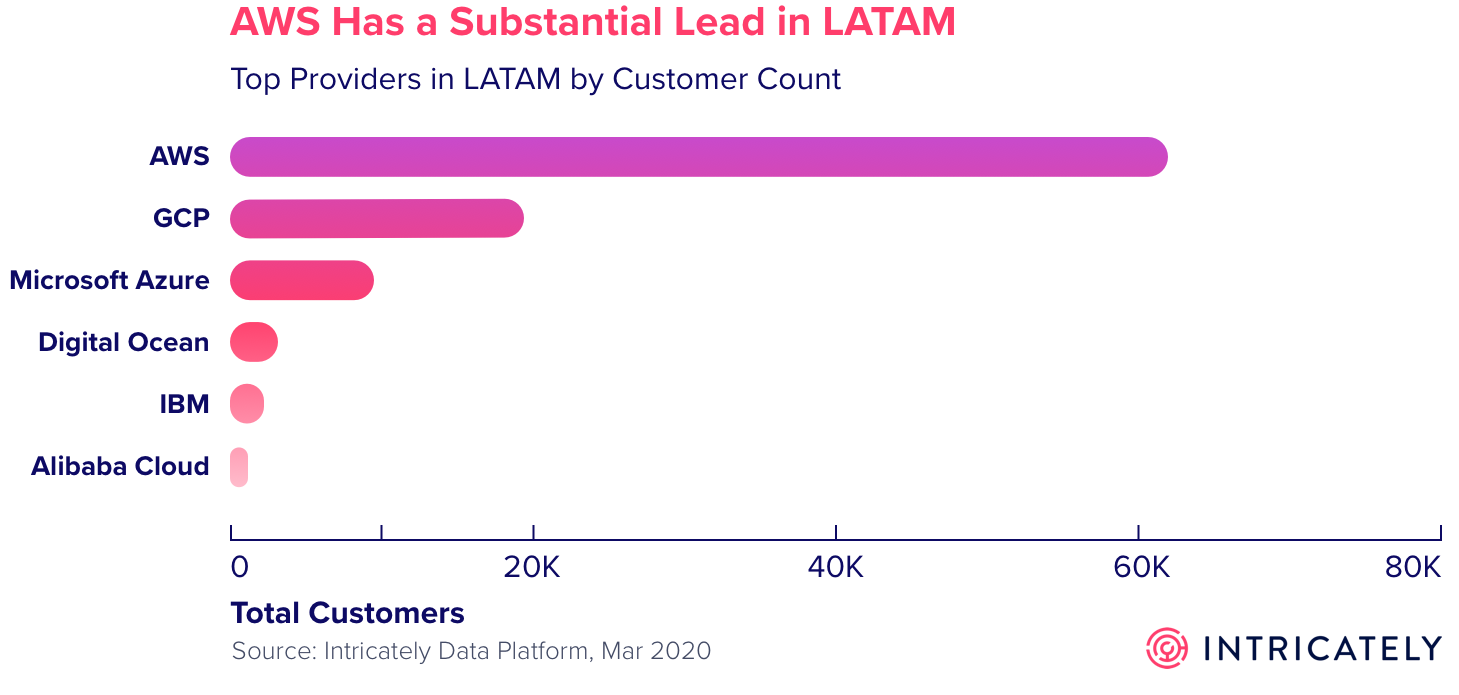

Trend 5: AWS Leads the LATAM Market

Customers in Latin America are looking for better application performance, security, and hybrid cloud solutions in the IaaS and PaaS segments. Companies in the region are also prioritizing stringent new compliance requirements in the wake of data protection regulations like the GDPR.

Cloud providers like IBM, Microsoft, and AWS are starting to roll out new cloud services in the region to meet IaaS customer demands.

Over the next 10 years, Amazon is estimated to spend $800 million on a new regional data center in Argentina, South America’s second-largest economy. Microsoft recently announced plans to invest $1.1 billion in Mexico over the next five years, which will include building a new Azure data center.

AWS is the clear leader in LATAM customers, followed by Google Cloud Platform and Microsoft Azure.

Gain More Insights in the 2020 Cloud Hosting Report

Ready to explore more 2020 cloud market trends and charts? Download the full 2020 Cloud Hosting Report.

The report features 22 pages of analysis and 10 data visualizations to answer questions such as:

- What is the customer market share of AWS, Microsoft Azure, and Google Cloud Platform?

- Who are the most popular cloud hosting providers among enterprises?

- How are cloud buyers distributed around the world?

- How much do companies spend on cloud hosting products?

3 Trends Shaping the Evolving Cloud Hosting Market

4 Ways Cloud Marketing Leaders Can Get the Most From Their Budgets in 2022

How to Perform Account Segmentation and Prioritization

Top Cloud Hosting Platforms In 2020

Introducing Intricately's State of the 2022 Cloud Hosting Market Report